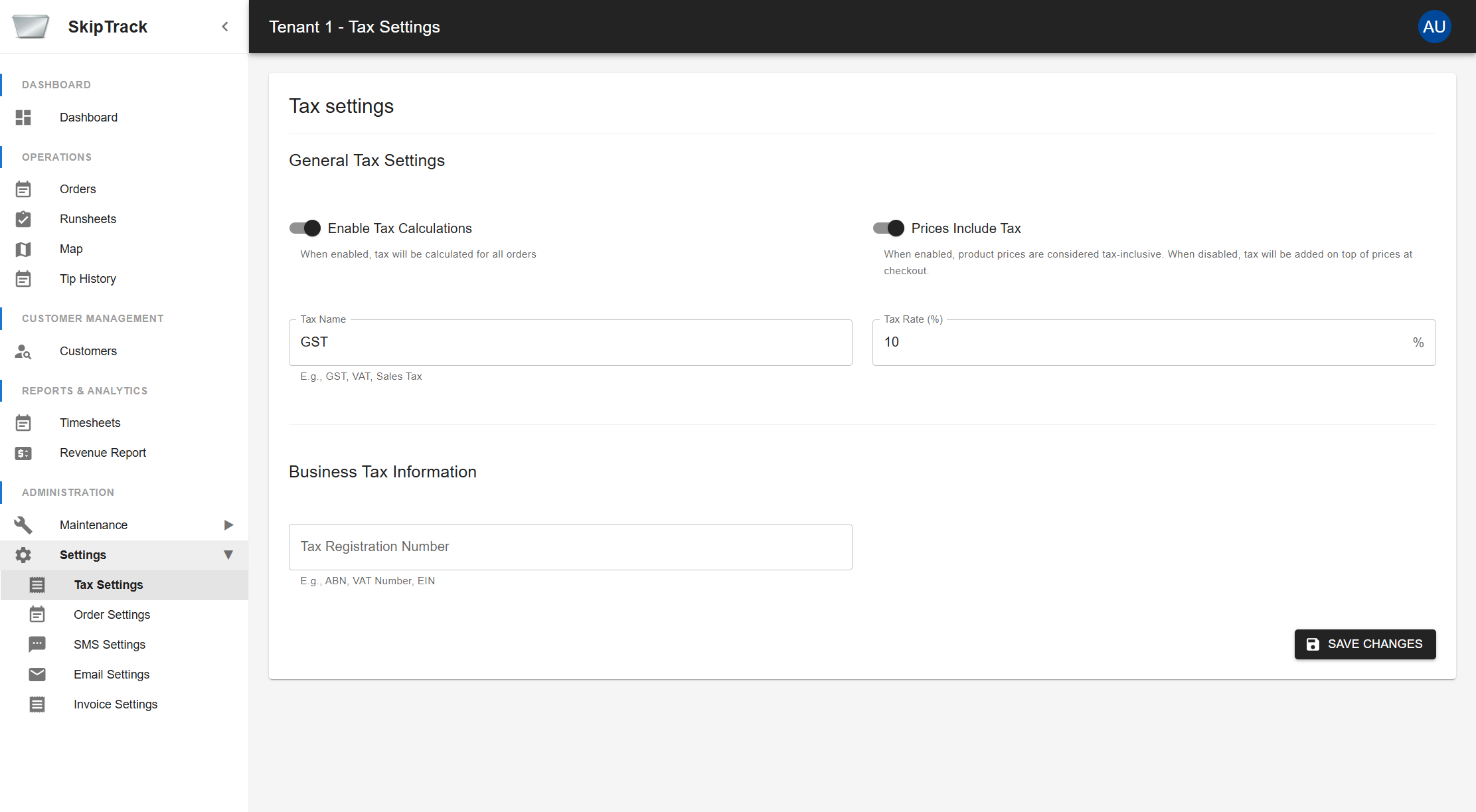

Tax Settings

Configure how taxes are calculated and displayed in your system.

General Tax Settings

Enable Tax Calculations

- When enabled, tax will be calculated for all orders

- Toggle this setting to turn tax calculations on or off system-wide

Prices Include Tax

- When enabled, product prices are considered tax-inclusive

- When disabled, tax will be added on top of prices at checkout

- This affects how prices are displayed to customers and calculated in orders

Tax Name

- Set the display name for your tax (e.g., GST, VAT, Sales Tax)

- This name appears on invoices and order summaries

Tax Rate (%)

- Set the tax percentage rate

- Enter as a percentage value (e.g., 10 for 10%)

Business Tax Information

Tax Registration Number

- Enter your business tax registration number

- Examples: ABN (Australian Business Number), VAT Number, EIN (Employer Identification Number)

- This appears on official documents and invoices

Saving Changes

Click Save Changes to apply your tax settings. Changes take effect immediately across the system.